jersey city property tax abatement

Section 40A21-13 - Assessed value of property under abatement or exemption. Property taxes in Illinois support city governments county governments and school districts along with a vast number of other local services and projects.

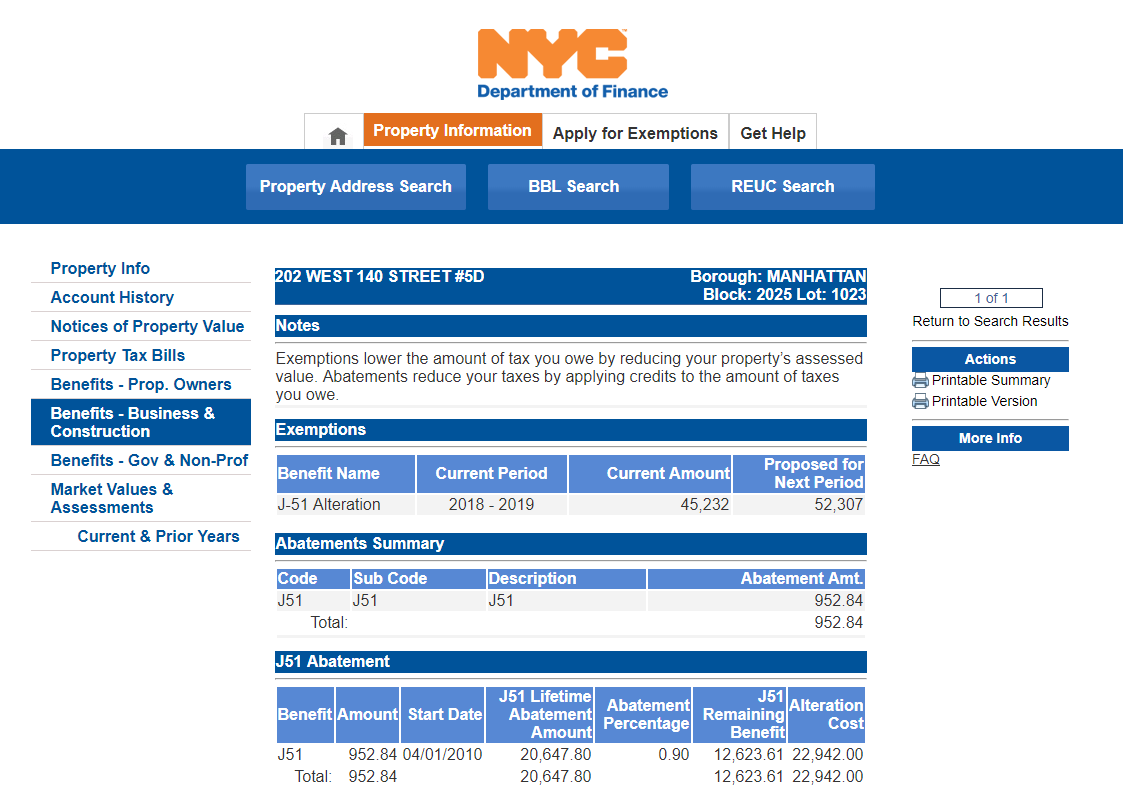

How Much Is The Coop Condo Tax Abatement In Nyc

The wages of Jersey City residents are exempt.

. To search for tax information you may search by the 15 to 18 digit parcel number last name of property owner or site address. Title 1 Department of Agriculture and Markets. That is also well over double the national average.

Department of State Archive Websites page. The Jersey City Division of Collections is responsible for collecting payments to the city - whether property or payroll taxes or abatement payments. Employers with a quarterly gross payroll less than 2500 are exempt from the payroll tax.

Compared to the 107 national average that rate is quite low. New Jersey has research and development credits capped at 50 of tax liability. Trump Plaza also known as Trump Plaza Residences is the first of two apartment complex buildings to be built in Jersey City New JerseyTrump Plaza Residences is 532 ft tall 162 m and has 55 floors and is the 7th tallest residential building in New JerseyIn 2020 the Trump name was removed from the properties and has been renamed the 88 Morgan Street.

To help you find what you are looking for. Section 40A21-11 - Tax agreements duration other law valuation of ratables copy to DCA. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt.

SF 714 - Financial Disclosure Report - Revised - 1192022. Specific tax rates in Illinois are determined based on the total tax base or the total value of property with a district. El Paso Co Es Dis No2.

Most penalties are at the discretion of the municipalities and vary from city to city. Tax on certain types of income you must attach a statement to Form W-9 that specifies the following five items. It appears they are fleeing California because of.

Lexis has the largest collection of case law statutes and regulations Plus 40K news sources 83B Public Records 700M company profiles and documents and an extensive list of exclusives across all. The New Jersey County Tax Boards Association established that all real property be assessed at 100 of its market value. Canyon Randall Co 2191018020000082500.

When searching choose only one of the listed criteria. This Friday were taking a look at Microsoft and Sonys increasingly bitter feud over Call of Duty and whether UK. A federal tax lien exists after.

This page may have been moved deleted or is otherwise unavailable. Caney City Henderson Co 2107066020000082500. 474 But a state lacks jurisdiction to extend its privilege tax to the gross receipts of a.

Search the most recent archived version of stategov. The lien protects the governments interest in all your property including real estate personal property and financial assets. Prop 30 is supported by a coalition including CalFire Firefighters the American Lung Association environmental organizations electrical workers and businesses that want to improve Californias air quality by fighting and preventing wildfires and reducing air pollution from vehicles.

It is the responsibility of the Manager to collect enforce and report on the revenue of the various businesses in the City of Newark and. Use our site search. 8 2022 the voters of Grand Rapids approved a local option sales tax that allows revenues to finance up to 5980000 for reconstruction remodeling and upgrades to the Grand Rapids IRA.

OF 122C-A - Transfer Order - Computers for Learning Program - Continuation. Return to the home page. Homeowners in Nevada are protected from steep increases in property tax bills by Nevadas property tax abatement law which limits annual increases in property tax bills to a maximum of 3 for homeowners.

Canton Van Zandt Co 2234044020000082500. CanyonRandall Co Assist Dist No. New Jersey allows corporations to carry forward losses from prior years.

However operating without a contractors tax license isnt a great idea. The median annual property tax payment in Norfolk County is 5592. New York Codes Rules and Regulations.

Check the URL web address for misspellings or errors. Meanwhile California is 16th lowest in property tax rates at 076. Taxes for multi-state corporations are apportioned using a three-factor formula of sales property and payroll.

Section 40A21-12 - Failure of conditions full taxes due termination. Still cant find what youre. Madison County Property Tax Inquiry.

Do not enter information in all the fields. The surprising truth about content. A municipal license tax imposed on a foreign corporation for goods sold within and without the state but manufactured in the city is not a tax on business transactions or property outside the city and therefore does not violate the Due Process Clause.

Its a Class 1 misdemeanor punishable by up to 1000 or a year in jail or both. Rapid City contractors will need to call the licensing office directly. Yet at 089 Florida is slightly below the national average property tax rate of 111 and Texas is seventh highest in property tax rates at 18.

The County Assessor determines each propertys the full and fair value as if it were to sell in fair and bona fide sale by private contract on the October 1 preceding the date the assessor completes the assessment list. Puts your balance due on the books assesses your. New York Codes Rules and Regulations Home.

Section 40A21-14 - Subsequent abatements or exemptions conditions. In New Jersey this apportionment is weighted at 502525. SF 180 - Request Pertaining to Military Records - Revised - 11152022.

Thus while property tax rates in the county are not especially high on a statewide basis property tax bills often are high. Illinois Property Tax Rates. The states average effective property tax rate is just 053.

Regulators are leaning toward torpedoing the Activision Blizzard deal. Office of Tax Abatement and Special Taxes insures that the service charges on tax abatement and taxes on payroll parking hotel room occupancy and business license and permits are accurately accounted for. These guides are the foundation from which landlords and property managers can prepare their properties for reopening and minimize the impact to tenants.

SF 425 - Federal Financial Report - Renewed - 11142022. Generally this must be the same treaty under which you claimed exemption from tax as a nonresident alien. 1 Randall Co 6191615020000082500.

Tax Credits Rebates Savings Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal incentives and rebates. Hello and welcome to Protocol Entertainment your guide to the business of the gaming and media industries. Contained in the saving clause of a tax treaty to claim an exemption from US.

The median home value in Norfolk County is 452500 more than double the national average.

5 Year Tax Abatement Jersey City Nj Real Estate 35 Homes For Sale Zillow

Mapping Affordable Housing Supported By The 421 A Tax Exemption Program Nyu Furman Center

Jersey City Abatement Policy Civic Parent

New York City S Solar Property Tax Abatement Ends Soon Solar Com

Buying An Apartment With A J 51 Tax Abatement Hauseit

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Jersey City Unfairly Burdens Small Homeowners With Property Tax Burden Opinion Nj Com

Mapping Jersey City S Abatements By Project Type And Ward Civic Parent

Tax Abatements In Jersey City A Vehicle For Growth Amp Prosperity

Mapping Jersey City S Abatements By Project Type And Ward Civic Parent

5 Year Tax Abatement Jersey City Nj Real Estate 35 Homes For Sale Zillow

Tax Abatements In Jersey City A Vehicle For Growth Amp Prosperity

Jersey City Abatement Policy Civic Parent

Mapping Jersey City S Abatements By Project Type And Ward Civic Parent

5 Year Tax Abatement Jersey City Nj Real Estate 35 Homes For Sale Zillow

Tax Abatements In Jersey City A Vehicle For Growth Amp Prosperity