does maine tax retirement pensions

Maine Revenue Services processes the Income Tax Withholding Quarterly Return Form 941ME as well as the Unemployment Contributions Report Form ME UC-1. You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs and similar retirement plans.

7 States That Do Not Tax Retirement Income

52 rows Maine.

. Reduced by social security received. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. Is my retirement income taxable to Maine.

Up to 6000 in other retirement pensions can be exempted from taxable income. Mainepng Snapshot of Te acher Retirement Maine Public Employees Retirement System Average pension value 2018. Retiree has not paid Federal or State taxes on the.

California Highest marginal tax rate. However that deduction is reduced in an amount equal to your annual Social. What is the pension income deduction.

133 for income above 537498 single and 1074996. Employer Self Service login Call us toll free. 51 rows The other state has no income tax You may not deduct income you received from a contributory annuity pension endowment or retirement fund of another state.

Retiree paid Federal taxes on contributions made before January 1 1989. 28421 Median pension value 2018. A A A Benefit Payment and Tax Information In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who.

Deduct up to 10000 of pension and annuity income. Recipients of an employer pension are entitled to choose not to have income tax withheld from their payments or to change their withholding election. The 10000 must be.

You also need to consider Maine retirement taxes as they apply to pensions and distributions when choosing a place to settle after working for so many years. For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor. Retiree already paid Maine state taxes on all of their contributions.

For example Maine offers a. June 6 2019 239 AM Maine allows for a deduction of up to 10000 per year on pension income. The Maine Public Employee Retirement System MPERS serves the public with sound retirement services to Maine governments.

In addition several states provide tax exemptions or exclusions for which Mass. They are listed in the chart below. To All MainePERS Retirees.

Windfall Provision Iis Financial Services Financial Advisor In Augusta Maine

403b Tsa Annuity For Public Employees National Educational Services

15 States That Don T Tax Retirement Income Pensions Social Security

States That Don T Tax Retirement Income Personal Capital

Legislation Maine Service Employees Association

For Some Mainers Retirement Isn T How They Envisioned Newscentermaine Com

Maine Among Priciest States To Retire Study Says Mainebiz Biz

Learn About Retirement Income And Annuity Tax H R Block

States That Don T Tax Military Retirement Turbotax Tax Tips Videos

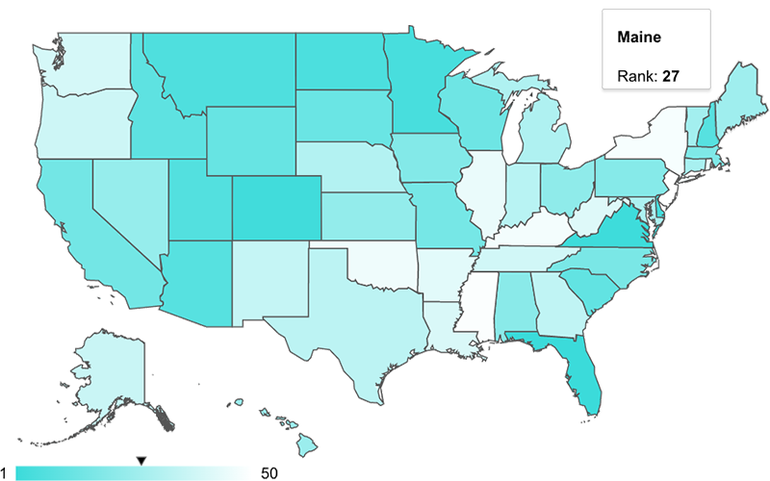

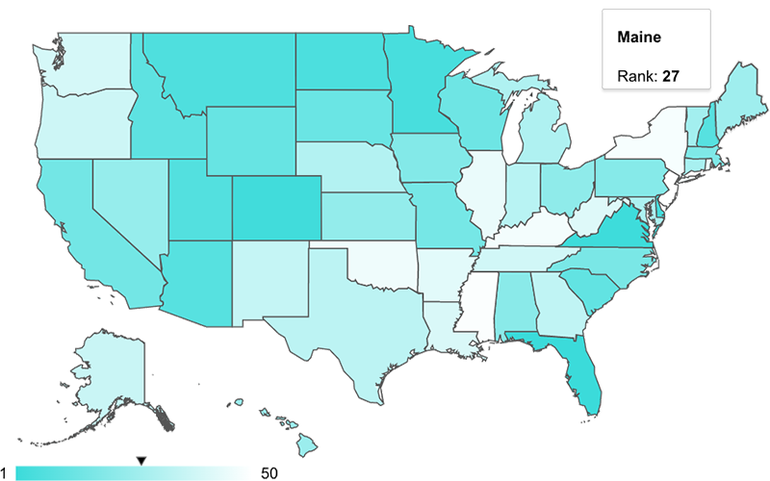

Best States To Live In Retirement

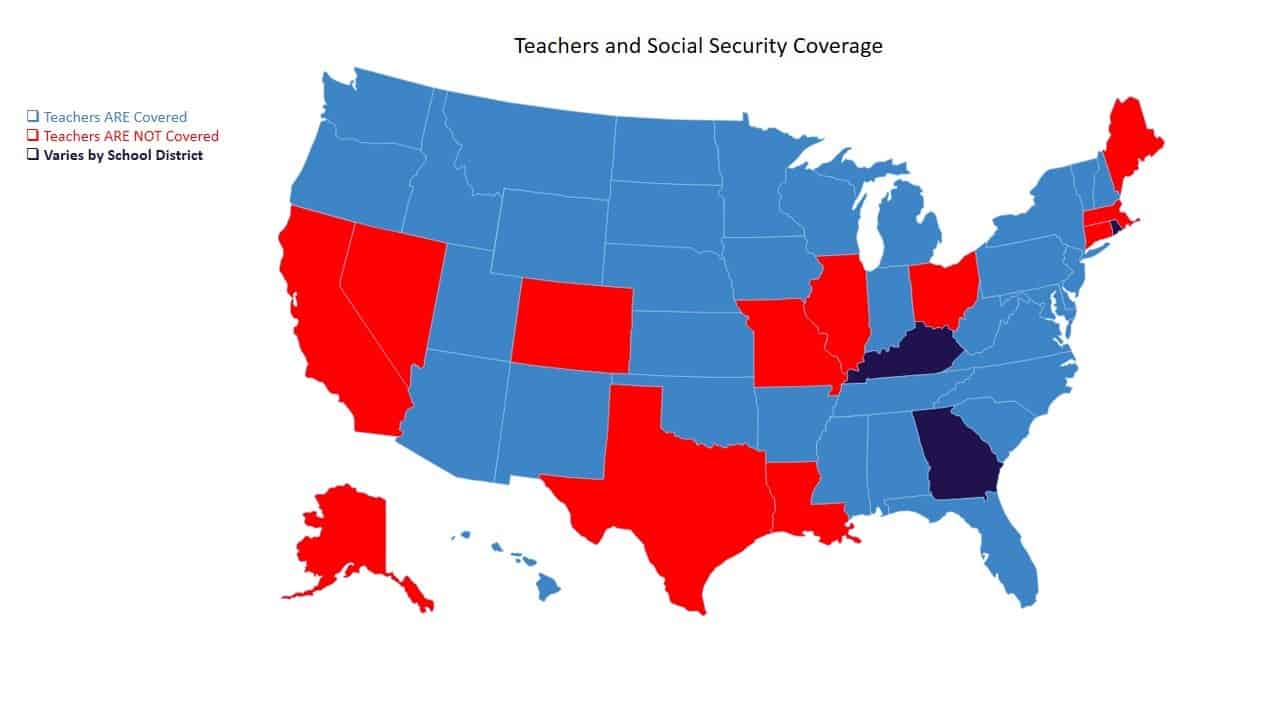

Teacher S Retirement And Social Security Social Security Intelligence

How To Determine The Most Tax Friendly States For Retirees

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

Kentucky S Pension Exclusion Doesn T Work

Pros And Cons Of Retiring In Maine Cumberland Crossing

10 Most Tax Friendly States For Retirees Kiplinger

In Unusual Move Maine Pension Considers Lowering Pe Target Buyouts